NCERT Solutions for Class 12 Accountancy Chapter 9 Analysis of Financial Statements

Detailed, Step-by-Step NCERT Solutions for 12 Accountancy Chapter 9 Analysis of Financial Statements Questions and Answers were solved by Expert Teachers as per NCERT (CBSE) Book guidelines covering each topic in chapter to ensure complete preparation.

Analysis of Financial Statements NCERT Solutions for Class 12 Accountancy Chapter 9

Analysis of Financial Statements Questions and Answers Class 12 Accountancy Chapter 9

Test Your Understanding-I (Page. No. 205)

Fill in the blanks with appropriate words :

(i) Analysis simply means data.

(ii) Interpretation means data.

(iii) Comparative analysis is also known as analysis.

(iv) Common-size analysis is also known as analysis.

(v) Tire analysis of actual movement of money inflow and outflow in an organisation of called analysis.

Answer:

(i) Simplification

(ii) Explaining

(iii) Horizontal

(iv) Vertical

(v) Cash Flow

![]()

Choose the right answer:

Question 1.

The financial statements of a business enterprise include :

(a) Balance sheet

(b) Profit and loss account

(c) Cash flow statement

(d) All the above

Answer:

(d) All the above.

Question 2.

The most commonly used tools for financial analysis are :

(a) Horizontal analysis

(b) Vertical analysis

(c) atio analysis

(d) All the above

Test Your Understanding-II (Page No. 220)

Answer:

(d) All the above.

Question 3.

An Annual Report is issued by a company to its :

(a) Directors

(b) Auditors

(c) Shareholders

(d) Management

Answer:

(c) Shareholders.

Question 4.

Balance Sheet provides information about financial position of the enterprise:

(a) At a point in time

(b) Over a period of time

(c) For a period of time

(d) None of the above

Answer:

(a) At a point in time.

Question 5.

Comparative statement are also known as :

(a) Dynamic analysis

(b) Horizontal analysis

(c) Vertical analysis

(d) External analysis

Answer:

(b) Horizontal analysis.

Test Your Understanding-III (Page No. 230)

State whether each of the following is True or False :

(a) The financial statements of a business enterprise include funds flow statement.

(b) Comparative statements are the form of horizontal analysis.

(c) Common size statements and financial ratios are the two tools employed in vertical analysis.

(d) Ratio analysis establishes relationship between two financial statements.

(e) Ratio analysis is a tool for analysing the financial statements of any enterprise.

(f) Financial analysis is used only by the creditors.

(g) Profit and loss account shows the operating performance of an enterprise for a period of time.

(h) Financial analysis helps an analyst to arrive at a decision.

(i) Cash Flow Statement is a tool of financial statement analysis.

(j) In a Common size statement each item is expressed as a percentage of some common base.

Answer:

(a) True

(b) True

(c) True

(d) True

(e) True

(f) False

(g) True

(h) True

(i) True

(j) True.

![]()

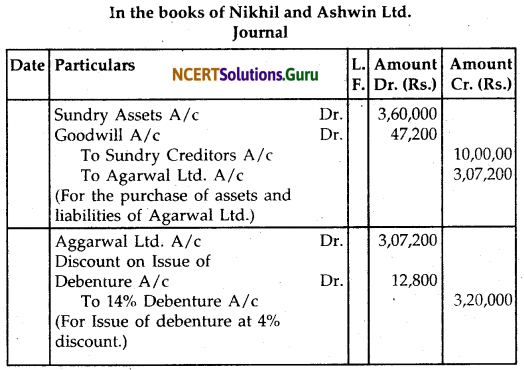

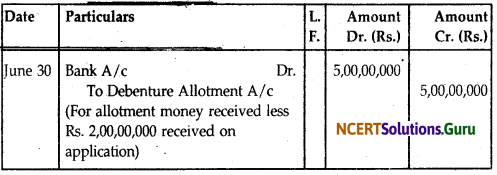

Do it Yourself (Page No. 212)

From the following balance sheet and income statement of Day Dreaming Co. Ltd., for the year ending 2005 and 2006, prepare the comparative statements.

Answer:

![]()

Answer:

Interpretation:

(i) The Comparative Income Statement reveals that there has been an increase in sales by 16.67% while the cost of goods sold has increased by 30.77%, thereby resulting in a decreases in Gross Profit by 20%. Although the operating expenses have remained constant, there has been decrease in net profit by 26.32% because of decline in Gross Profit.

![]()

(ii) The Companies current Assets have increased by Rs. 140 Lakhs i.e. 16.47% whereas the current liabilities have increased by 125 Lakhs (22.73%).

(iii) Shareholders Funds have increased by 45 Lakhs i.e. 3%.

(iv) The overall financial position of the company is satisfactory.

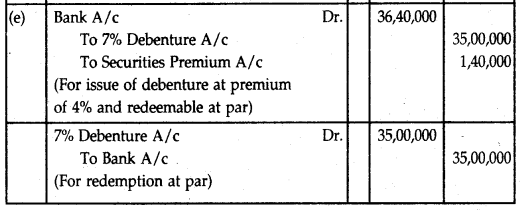

Do it Yourself (Page No. 219)

The following are the Balance Sheets of Harsha Ltd. as on March 31, 2006 and March 31,2007

Prepare Common-Size Balance Sheet and interpret the same.

Answer:

Interpretation:

(i) In the year 2006, Current Assets have increased from 47.83% to 48.53%. Cash Balance increased by 4.42% from 2.18%.

(ii) Current Liabilities decreased from 27.18% to 22.06% implying that the company has paid the Current Liabilities from Current Assets. Even then, the liquidity position’s reasonably good.

![]()

(iii) Fixed Assets increased from Rs. 1,20,000 in 2005 to Rs. 1,75,000 in 2006 as a result of Purchase of Fixed Assets by the additional issue of Share Capital.

(iv) The overall Financial Position of the Company is satisfactory.

Do it Yourself (Page No. 222)

The following data is available from the P & L AJc of Deepak

You are required to show Trend Percentages of different items.

Interpretation:

(i) The sale for the year 2004 and 2006 have increased but the sales for the year 2005 have decreased. It is not a good sign for the business.

(ii) The wages paid to the employees is continuously increasing and the selling expenses are also increasing

(iii) The Gross Profit for the year 2003 is 100 and for the year

2004 is 106 but it has gradually decreased for the period 2005 and 2006.

(iv) The Firm should reduce its expenses in order to increases the gross profit. The overall performance is not satisfactory.

Short Answer Type Questions

Question 1.

List the techniques of Financial Statement Analysis.

Answer:

The process of critical examination of the financial information contained in the Financial Statement in order to understand and make decision regarding the operations of firm is called the ‘Financial Statement Analysis’. Basically, it is a study of the relationship among various financial facts and figures as given in a set of Financial Statements.

“Financial Statement analysis is designed to indicate the strength and weaknesses of business undertaking through, the establishment of certain crucial relationship by regrouping and analysis of figures contained in financial statements.” —J.N. Myres

“Financial Statement analysis is largely a study of relationships among the various financial factors in a business, as disclosed by a single set of statements and a study of trends of these factors, as shown in a series of statements.’—Myer

![]()

Techniques of Financial Statement Analysis:

Financial Statements indicate certain absolute information about assets, liabilities, equity, revenues, expenses and profit or loss of an enterprise. They are not readily understandable to the external users of accounts. The users of accounts need information about profitability, solvency and liquidity of the enterprise. Accordingly various techniques are employed for analysing the financial statements.

The following are the main techniques for analysis of the financial statements—

(i) Comparative Statement Analysis.

(ii) Common Size Statement Analysis.

(iii) Trend Analysis.

(iv) Ratio Analysis.

(v) Cash Flow Analysis.

(i) Comparative Statement Analysis : Comparative statements compares financial numbers at two points of time and helps in driving meaningful conclusions regarding the changes in financial positions and operating results and to enable the reader to understand the significance of such changes.

Such comparison of financial statements is accomplished by setting up Balance Sheet and Profit and Loss Account side by side and studying the changes that have occurred in the individual figure therein from year to year and over the years.

Thus, Comparative Statements are those which summarise and present relating data for a number of years incorporating therein the changes in individuals items of financial statements. This analysis is also known as Horizontal Analysis.

(ii) Common Size Statement Analysis: These Statements indicate the relationship of different items of a Financial Statements with some common item by expressing each item as a percentage of the common item. The percent thus calculated can be easily compared with the corresponding percentages of some other firms, as the number are brought to common base. This analysis is also known as ‘Vertical Analysis’.

(iii) Trend Analysis: It is a technique of studying several Financial Statements over a series of years. Using the previous years, data of a business enterprise, trend analysis can be done to observe the percentage changes over time in the selected data. Trend analysis is important because, with its long run view, it may point to basic changes in the nature of the business. By looking at a trend in a particular ratio, one may find whether the ratio is falling, rising or remaining relatively constant.

![]()

(iv) Ratio Analysis: Accounting ratios measure the comparative significances of the individual items of the income and position statements. It is possible to assess the profitability, solvency and efficiency of an enterprise through the techniques of ratio analysis.

(v) Cash Flow Analysis : It refers to the analysis of actual movement of cash in to and out of an organisation. Cash Flow Statements is prepared to project the manner in which the cash received has been utilised during an accounting year. It is a statement, which shows the sources of cash receipts and also the purposes for which payments are made. Thus, it summarises the causes for the changes in cash position of a business enterprise between dates of two balance sheets.

Question 2.

Distinguish between Vertical and Horizontal Analysis of financial data;

Answer:

Horizontal Analysis : This analysis is made to review and analyse financial statements of a number of years and are, therefore based on financial data taken for those years. It is a time series analysis. It shows comparison of financial data for several years against a chosen base year. This is very useful for long term trend analysis and planning. Comparative Financial Statement is an example of this type of analysis.

Vertical Analysis : This analysis is made to review and analyse the financial statements of one particular year only. This type of analysis is also called ‘Statistics Analysis’ as it is frequently used for referring to ratio’s developed for one date or for one accounting period. Such an analysis is useful in company or the performance of several companies in the same group or divisions or departments in the same enterprise.

![]()

Difference between Horizontal Analysis and Vertical Analysis

| Horizontal Analysis | Vertical Analysis |

| 1. It requires comparative financial statements of two or more accounting periods. 2. It is a part of comparisons. 3. It provides information in absolute and percentage form. 4. It deals with same item of different periods. 5. It is generally used for time series analysis. | 1. It requires a statement of one period. 2. It is a step towards comparisons. 3. It provides information in, percentage for money. 4. It deals with different items of same period. 5. It is generally used for crosssection analysis. |

Question 3.

Explain the meaning of Analysis and Interpretation?

Answer:

Analysis of Financial Statements is the process of identifying the financial strengths and weaknesses of the firm by properly establishing relationship between the items of the Balance Sheet and Income Statement. Whereas, Interpretation involves explaining the meaning and significance of the relationship so established by the analysis. Thus, analysis provide the basis for interpretation.

Question 4.

Bring out the importance of Financial Analysis.

Answer:

Financial Statement Analysis are very important and useful to all those who are interested in the well-being of the business in one way or the other. It is an important part of over all financial assessment. It is based on the statements which are the end product of accounting system, i.e. Balance Sheet and Profit & Loss A/c and the Statement of Source and Application of Funds. The financial analysis serves the following purposes and that brings out the importance of such analysis:

![]()

1. To judge the financial soundness of the business concern : On the basis of financial statement, the solvency of the concern may be judged i.e. the long term, as well as short term solvency of a business, can be judged from the information contained in the financial statements.

Debenture holders and lenders judge the ability of the company to pay the principal and interest as most of the companies raise a portion of their capital requirements by issuing debentures and raising long term loans.

Trade creditors are mainly interested in assessing the short term solvency of the business as they want to know that the business is in a position to pay debts as and when they fall due.

2. To judge the Managerial Efficiency: The financial statement analysis helps to pinpoint the areas wherein, the managers have shown better efficiency and the areas of inefficiencies.

3. Inter firm comparison: Analysis of financial statement makes it easy to make inter-firm comparison. The inter-firm comparison helps in assessing own performance as well as that of others if mergers and acquistions are considered. This comparison can also be made for various time periods.

4. To judge the Earning Capacity or Profitability: On the basis of financial statements, the earning capacity of the business concern may be computed. In addition to this the future earning capacity of the concern may be forecasted.

5. Making Forecasts and Preparing budgets : Past financial statements analysis helps a great deal in assessing developments in the future, specially the next year. Analysis thus helps in preparing budgets.

Question 5.

What are Comparative Financial Statements?

Answer:

Comparative statements compare the financial numbers at two points of time and captures changes in the same. The change could be presented in absolute amount or in comparative terms such as percentage.

Under this method, the following informations are presented by’ the comparative financial statements :

(i) Absolute money values of different items.

(ii) Increase or decrease in absolute data in terms of money values.

(iii) Increase or decease in absolute data in terms of percentage.

![]()

For the purpose of analysis, various comparative statements are prepared. Out of these, important ones are :

1. Comparative Balance Sheet

2. Comparative Profit and Loss A/c

3. Comparative Statement of Cost of Production

4. Comparative Statement of Working Capital.

1. Comparative Balance Sheet—In comparing Balance Sheet, the items of Balance Sheet for two or more periods are presented in a manner that increase or decrease in assets and liabilities between these periods can be ascertained easily. All business transactions affect assets, liabilities and capital presented in the balance sheet. Changes in the items can be known by comparing balance sheets at the beginning and end of the year. Thus, comparative balance sheet is very important to determine tendencies for business.

Significance of Comparative Balance Sheet:

(i) Comparative Balance Sheet is quite significant for an analyst, because it not only provides infonnations about various items on a particular date, but also the changes in these items between two periods can be ascertained.

(ii) With the help of Comparative Balance Sheet future trends of assets, liabilities and captial can be ascertained. It helps prepare the plans easily.

(iii) The profit and loss account of business acts as a link between the balance sheets of two dates. The quantum of profit or loss affects the items of balance sheet.

2. Comparative Profit and Loss Account—Comparative Profit and Loss Account represents net profit or net loss in a period of time. It helps to determine whether sales, cost of sales, gross profit or net profit have increased or decreased. Besides absolute increase or decrease in various items of profit and loss acount, they also be shown in percentage terms.

To analyse the items in profit and loss A/c, the analyst should compare the changes in cost of sales and operating expenses with the changes in sales. The increase or decrease in gross profit should be considered with reference to sales. Net profit can also be compared with income.

3. Comparative Statement of Cost of Production—The comparative statement of cost of production can present absolute increase or decrease, percentage increase or decrease in each item of cost of production and the proportion of that item to the cost of production. It will help in finding out what changes in each item of cost of production have occured and what are their effects on cost of production. It will help in taking proper decisions to control the cost in future.

4. Comparative Statement of Working Capital—The Comparative Statement of Working Capital helps find out changes (increase or decrease) in the working capital, each of the current assets, each of the current liabilities, total current assets and total current liabilities. By comparing the changes in current assets and current liabilities, the liquidity of business can be evaluated.

![]()

Question 6.

What do you mean by Common-Size Statements?

Answer:

Common-Size Statement : Common-Size Statement also known as component percentage statement, is a financial tool for studing the key changes and trends in the Financial Position (Balance Sheet) and Financial Result (Profit and Loss A/c) of a company. In this figures reported are converted into percentages of some common base. For example, Total assets may be chosen as a measures size for Balance Sheet and Sales may act as a measure size for Profit and Loss A/c.

These statements are known as common size statements, because all the figures are converted into a common size.

Purpose: An Analysis of common size statement will help better understand the important changes which have occured in the enterprise over a period of time. This analysis constitute a vertical study within one column of the comparative statement therefore, it is also called as vertical analysis.

Importance: An analysis of commorisize statement is of immense use which comparing business enterprise which differ substantially in size as it provides an in sight into the structure of financial statements.

Common Size Balance Sheet :

In Common Size Balance Sheet, each item of assets is shown as percentage of total assets and each item of liability is shown as a percentage of total liabilities. The total of the assets and that of liabilities is taken as 100 percent and each item, appearing on the assets side as well as liabilities side is shown as proportion of the total of 100. It is also known as Percentage Balance Sheet.

Common Size Income Statement : Income Statements are reduced to common size by expressing each item as a percentage of net sales. Thus, the Common Size Income Statement captures the relationship between sales and expenses.

![]()

Steps:

The following steps may be followed to prepare the common size statements:

1. Draw table with the five columns like.

2. List out absolute figures in ruppees at two different point of time.

3. Choose a common base (as 100). For example, Sales revenue total may be-taken as base (100) in case of Profit and Loss A/c and total assets or total liabilities (100) in case of Balance Sheet.

4. Convert all items of Col. 2 and Col. 4 as a percentage of that total. Column 3 and 5 portray these percentages.

The purpose of common-size analysis is to know the importance of each item in the total. Hence, this analysis can be done for one year also.

Long Answer Type Questions

Question 1.

Describe the different techniques of financial analysis and explain the limitations of financial analysis.

Answer:

Following are the main tools or techniques of financial analysis :

1. Comparative Financial Statements

2. Common-Size Statements

3. Ratio Analysis

4. Fund Flow Statement

5. Cash Flow Analysis.

6. Trend Analysis.

1. Comparative Financial Statements—By preparing comparative statement, the nature and quantum of change in different items can be calculated and it also helps in future estimates. By comparing with the data of the previous years, it can be ascertained what type of changes in different items of current year have taken place and the future trend of business can be estimated.

For the purpose of analysis, various comparative statements are prepared. Out of these, important ones are :

- Comparative Balance Sheet

- Comparative Profit and Loss A/c

- Comparative Statement of Cost of Production

- Comparative Statement of Working Capital.

While preparing comparative statements, it should be ensured that the financial statements of different years used for comparison are based on same principles and procedures so that uniformity can be attained, otherwise; data will not be comparable.

2. Common-Size Statements—Common-size statements are such statements in which items of the financial statements are converted in percentage on the basis of a common base. In common-size Income Statement, net sales may be considered as 100%. Other items can be converted as its proportion. Similarly, for the Balance Sheet items total assets or total liabilities may be taken as 100% and proportion of other items to this total can be calculated in percentages.

![]()

3. Ratio Analysis—Ratio is quantitative relationship between two items for the purpose of comparison. For example, profit is related to capital invested in business, and debtors are dependent on credit sales.’Ratio helps in drawing meaningful conclusions by establishing relationship between various facts.’

4. Fund Flow Statement—Fund flow statement is a technique of analysing financial statements. The fund flow statement is a statement which is prepared to ascertain the changes in funds between two balance sheets of an institution. Fund flow statement is a statement ‘of sources and applications of funds, is a technical device designed to highlight the changes in the financial condition of business enterprise between two dates.

5. Cash Flow Statement—Cash flow statement is such a statement which expresses the reasons of changes in cash balances of business between two dates. This statement attempts to analyse the transactions of the firm in terms of cash. It shows the cash inflows and outflows.

6. Trend Analysis—Comparative and Common-size-statements signifies that meaningful conclusions could be drawn regarding the operating performance and financial position of the enterprise. Both of the analysis use percentage figures in helping an analyst to form an opinion. These percentage could be calculated for a number of successive years in order to understand trend of financial statement item and This analysis is known as ‘trend analysis’.

Limitations of Analysis of Financial Statements—Financial statements help the interested parties in assessing the profitability and financial soundness of a concern. However, these statements have certain limitations which must be kept in mind while using the information provided by them. Some of the limitations are as follows :

1. Incomplete information—These statements provide only the interim report of the business and do not give the final picture. They provide only the incomplete information because the actual profit or loss of a business can be known only when the business is closed down.

2. Based on accounting concepts and conventions—Financial statements are prepared on the basis of number of accounting concepts and conventions. Hence, the profitability and the financial position disclosed by these statements, may not be realistic.

For example, fixed assets are shown in the balance sheet according to the ‘going concern concept’. This means that the fixed assets are shown at their cost and not at their market value. The values realised on their sale may be more or less than the values stated in the balance sheet.

Similarly, on account of convention of conservation, the profit and loss account does not disclose the true profit of the business because future losses are provided whereas future incomes are ignored. There are certain assets in the balance sheet like goodwill, preliminary expenses, discount on issue of shares which will realise nothing but they are shown in Balance Sheet.

3. Omission of Qualitative Information—Financial Statements contain only those informations which can be expressed in terms of money. Qualitative aspects of business units are omitted from the books at all, as these cannot be expressed in monetary terms.

Thus, changes in management-labour relations, firm’s ability to develop new products, efficiency of management, satisfaction of firm’s customers etc. which has a vital bearing on the profitability of the firm are all ignored and omitted from being recroded because all these are qualitative in nature.

4. based on Historical Costs—Financial statements are prepared

on the basis of historical costs and as such the figures given in fianancial statements do not show the effect of price level changes. Hence, they provide only the historical costs (original costs) which are not useful for decision making. ,

5. Influenced by Personal Judgement—Financial statements are affected by the personal judgement of the accountant. Accountant has to exercise his personal judgement in respect of various claims such as the method of depreciation, method of valuation of stock (such as first in first out, or last in first out) and the period during which the deferred revenue expenditure (such as preliminary expenses) are to be written off. The soundness of such judgements depend upon the competence and integrity of the accountant.

6. Uncomparable—In many cases, the financial statements of various firms, which are in the same industry and very much similar, are uncomparable because of difference of method of depreciation, method of valuing stock and difference in adoption of different accounting procedure.

7. Affected to Window Dressing—Window Dressing refers to the practice of manipulating accounts so that the financial statements may disclose a more favourable position than the actual position. For example, the purchases made at the end of the year may not be recorded or the closing stock may be over-valued. Hence, correct decisions cannot be taken on the basis of such financial statements.

![]()

8. Unsuitable for forecasting—Financial statements are only a record of past events. Continuous changes take place in the demand of the product, policies adopted by the firm, the position of competition etc. As such, the financial analysis based on past events may not be of much use for forecasting.

9. Effect of capital market regulations—The capital market regulations also impact the quality and quantity of disclosure in financial statements. Before the insertion of clause 32 and clause 49, in the Listing Agreement, companies were not disclosing about the cash flow and corporate governance matters.

10. Poor Quality of Auditing Standards and Ethics—Poor Quality of auditing standards and professional ethics of the Chartered Accountants in India affect the quality of accounting reports. The increase in accounting scandals, across the globe has compelled the Governments to tighten the code of conduct and quality standards for audit both for Government and Private Enterprises.

The setting up of the Public Oversight Board (POB) in the U.S.A. and Proposed Review Board in India in the Institute of Chartered Accountants, Cost Works Accountants and Company Secretaries is a step towards improving the compliance and quality.

Question 2.

Explain the usefulness of trend percentages in interpretation of financial performance of a company.

Answer:

Trend Analysis: The financial statements may be analysed by computing trends of series of information. Trend analysis determines the direction upwards or downwards and involves the computation of the percentage relationship that each item bears to the same item in the base year. In Trend Analysis, we would like to know the behaviour of the same item over the period, say during the last 5 years.

In other words, Comparative and Common Size Statements present the percentage of each item to the total sum. These percentages could be calculated for a number of successive years in order to understand trend of financial statement item and this analysis is called as trend analysis. Trend in general term signifies a ‘Tendency’.

The review and appraisal of tendency in accounting data are nothing but trend analysis. It discloses’ the change in the financial and operating data between specific period and make possible for the analyst to form an opinion as to whether favourable or unfavourable tendencies are reflectd by the accounting data.

![]()

Purpose and Importance:

- It helps in future forecasts of various items as the basis of data of previous year.

- In this method, mass complex accounting data are converted into % and presented in brief, so the direction of business can be easily detected.

- There is less chance of mistakes because changes in percentages can be compared in changes in absolute data.

- It is very easy method to calculate that even a layman can also use this method.

Question 3.

What is the importance of comparative statements? Illustrate your answer with particular reference to comparative income statement.

Answer:

Meaning of Comparative Financial Statements— Comparative financial statement is a tool of financial analysis that depicts change in each item of the financial statement in both absolute amount and percentage term, taking the item in preceding accounting period as base.

Importance of Comparative Finacial Statement-

(1) Comparative statements give information about nature of changes influencing financial position and performance of an enterprise. From financial point of view, it is very useful.

(2) These statements point out the weakness and soundness about liquidity, profitability and solvency of an enterprise.

(3) By analysis of changes of financial data of previous years, these statements help the management in forecasting and planning.

(4) It is a guide to appreciate the movements of the key financial statistics.

Preparation of Comparative Profit and Loss Accounts – A Comparative Income Statement, like Comparative

![]()

Balance Sheet, is prepared having the columns for :

- Particulars

- Data of previous year’s Income Statement;

- Data of current year’s Income Statement;

- Absolute change in the data as per columns (i) and (ii) above; and

- Percentage change in the data as per columns (i) and (ii) above.

The following statement illustrates the Comparative Income Statements.

Question 4.

What do you understand by analysis and interpretation of financial statements? Discuss their importance.

Answer:

Meaning of Financial Statement Analysis: The process of critical examination of the financial informantion contained in the financial statements in order to understand and make decisions regarding the operations of firm is called the ‘Financial Statement Analysis’. Basically, it is a study of the relationship among various financial facts and figures as given in a set of financial statements.

“Financial statement analysis is designed to indicate the strength and weaknesses of business undertaking through the establishment of certain crucial relationship by regrouping and analysis of figures contained in financial statements.” — J.N. Myres

“Financial statement analysis is a judgemental process which aims to estimate current and past financial position and the results of the operations of an enterprises with the primary objective of checking the best possible estimates and predictions about future conditions.” — Bynstein

Thus, Analysis of Financial Statements is the process of identifying the financial strengths and weaknesses of the firm by properly establishing relationship between the items of the Balance Sheet and Income Statement.

The term ‘Financial Analysis’ includes both ‘analysis and interpretation’. The term analysis means simplification of financial data of methodical classification given in the financial statements. Interpretation means explaining the meaning and significance of the data so simplified.

![]()

Financial statement analysis are very important and useful to all those who are intersted is the well being of the business in one way or the other. It is an important part of over all financial assessment.

It is based on the statements which are the end product of accounting system, i.e. Balance Sheet and Profit & Loss A/c and the statement of Source and Application of Funds. The financial analysis serves the following purposes and that brings out the importance of such analysis:

1. To judge the financial soundness of the business concern : On the basis of financial statement, the solvency of the concern may be judged i.e. the long term as well as short term solvency of a business can be judged from the information contained in the financial statements.

Debenture holders and lenders judge the ability of the company to pay the principal and interest as most of the companies raise a portion of their capital requirements jury issuing debentures and raising long term loans.

Trade creditors are mainly interested in assessing the short term solvency of the business as they want to know that the business is in a position to pay debts as and when they fall due.

2. To judge the Managerial Efficiency: The financial statement analysis helps to pinpoint the areas wherein the managers have shown better efficiency and the areas of inefficiencies.

3. Inter firm comparison: Analysis of financial statement makes it easy to make inter-firm comparison. The inter-firm comparison helps in assessing own performance as well as that of others if mergers and acquisitions are considered. This comparison can also be made for various time periods.

4. To judge the Earning Capacity or Profitability: On the basis of financial statements, the earning capacity of the business concern may be computed. In addition to this the future earning capacity of the concern may be forecasted.

5. Making Forecasts and Preparing budgets : Past financial statements analysis helps a great deal in assessing developments in the future, specially the next year. Analysis thus helps in preparing budgets.

Question 5.

Explain how common size statements are prepared giving an example.

Answer:

Common-Size Statements : Common-size statements express all items of a financial statement as a percentage of some measure of size items of the enterprise. For example, Assets may be chosen as a measure of size for Balance Sheet and Sales may act as a measure of size for Profit and Loss Account.

For example, in case of Profit and Loss Account, each item is expressed as a percentage of Sales. Thus, the Common Size Profit and Loss Account captures the relationship between Sales and Expenses. One can draw conclusion regarding the behaviour of expenses over period of time by examining these percentages.

![]()

Common-Size Statements are those in which individual figures are converted into percentages to some common base. In Balance Sheet, the total of assets or liabilities is assumed to be equal to 100 and all the figures are expressed as percentage of this total.

Similarly, in Profit and Loss Account, sales figures is taken as 100 and all other figures are expressed as percentage of sales. With the help of following example Common Size Balance Sheet may be understood easily.

Illustration : Prepare a common size balance sheet from the following and interpret it:

Balance Sheet as on 31st December 2005 and 2006

Answer:

![]()

Working Note: All percentages will be calculated on the basis of total of Balance Sheet assets and liabilities in 2005 percentages will be based on Rs. 20,00,000 and in 2006 percentages will be based on Rs. 25,00,000

Interpretation : In 2005, current assets were 40% of total assets. In 2006, these have increased to 45.75%. Current Liabilities have also increased from 21% to 24%. Because of greater increase in current assets than in current liabilities, the position of working capital has improved. The percentage of fixed assets has come down from 60% in 2005 to 54.25% in 2006. Owner’s Equity has remained constant at 64% in both the years.

Common-Size Income Statement or P & L A/c :

From the following example of income statement, prepare the Common-Size Statement:

Answer:

Interpretation : In 2006, the cost of goods sold during the year has reduced by 4.50 percent. This reduction has taken place due to reduction in the cost of raw-material. Due to this reduction, the gross profit has increased from 39.30 percent to 43.80 percent.

The operating expenses have decreased by 2.30 percent which is an indicator of operating efficiency of business. Due to the joint effect of decrease in cost of goods and operating expenses there has been an increase of 6.80 percent in the net operating income which increased from 9.30 percent to 16.10 percent in 2006. It can be concluded that in 2006, company has worked more efficiently as compared to 2005.

![]()

Utility of common-size statements : These statements are very useful for comparing the profitability and financial position of two or more businesses. This is because the financial statements of different firms can be converted into uniform common-size format irrespective of the size of individual items. However, the comparison will be valid only when the accounting policies used by various firms are similar.

Numerical Questions

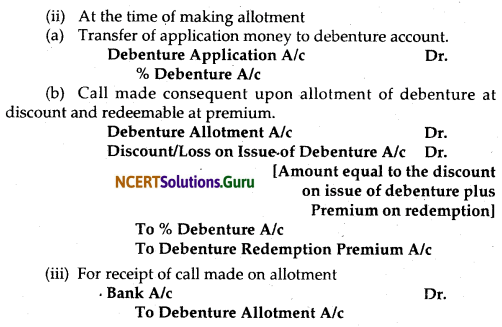

Question 1.

From the following information of Narsimham Company Ltd., prepare a Comparative Income Statement for the years 2004-2005.

Answer:

![]()

Question 2.

The following are the Balance Sheets of Mohan Ltd., at the end of 2004 and 2005.

Prepare a Comparative Balance Sheet and Study the financial position of the company.

Answer:

Interpretation: In 2005, the current assets has decreased by 23.54 percent due to purchase of Plant and Machinery. Equity Share Capital has raised by 50 percent by issuing shares. Debentures and Long term loans has been also increased during 2005. The position of Mohan Ltd. is satisfactory at the end of 2005.

![]()

Question 3.

The following are the Balance Sheets of Devi. Co. Ltd at the end of 2002 and 2003. Prepare a Comparative Balance Sheet and study the financial position of the concern.

Answer:

![]()

Interpretation : Here, in 2003, Devi Co. Ltd. show all round increase. Its current assets, fixed assets, current liabilities and fixed liabilities, all were increased significantly. But the increase in current assets is not equal or more than current liabilities, which show that its short term solvency position is not very good. But its long term solvency position is fair.

Question 4.

Convert the following income statement into Common- Size Statement and interpret the changes in 2005 in the light of the conditions in 2004.

Answer:

Interpretation: In 2005, the cost of goods sold during the year has reduced by 4.45 percent. This reduction has taken place due to reduction in the cost of raw material. Due to this reduction the gross profit has increased from 39.34 percent to 43.79 percent.

![]()

The operating expenses has decreased by 2.24 percent which is an indicator of operating efficiency of business. Due to the joint effect of decrease in cost of goods and operating expenses there has been an increase of 6.79 percent in the net operating income which increased from 10.33 percent to 17.12 percent in 2005. It can be conclued that in 2005, company has worked more efficiently as compared to 2004.

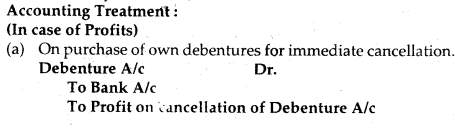

Question 5.

Following are the Balance Sheets of Reddy Ltd. as on 31 March 2003 and 2004.

Analyse the financial position of the company with the help of the Common-Size Balance Sheet.

Answer:

Interpretation:

(i) In the year 2005, Current Assests have decreased from 44.20% to 25.74%. Cash and Bank Balances decreased from 10.05% to 0.69%.

![]()

(ii) Current Liabilities decreased from 22.32% to 8.84%, implying that the company has paid the current libilities from current assets. Even then, the liquidity position of firm is reasonably good.

(iii) Fixed Assets increased from Rs. 3,930 to Rs. 6,398 in 2005 as resqlt of purchase of Fixed Assets by additional issue of share capital and debentures.

(iv) The overall Financial Position of the Reddy Ltd. is statisfactory.

Question 6.

The accompanying balance sheet and profit and loss account related to SUMO Logistics Pvt. Ltd. convert these into common size statements.

Answer:

Question 7.

From the following particulars extracted from P&L A/c of Prashanth Ltd., you are required to calculate trend percentages

Answer:

![]()

Question 8.

Calculate trend percentages from the following figures of ABC Ltd., taking 2000 as base and interpret them.

Answer:

Trend Percentages of ABC Ltd.

Question 9.

From the following data relating to the Liabilities side of balance sheet of Madhuri Ltd., as on 31st March 2006, you are required to calculate trend percentages taking 2002 as the base year.

Answer:

![]()

NCERT Solutions for Class 12 Accountancy Chapter 9 Analysis of Financial Statements Read More »