TS Grewal Accountancy Class 12 Solutions Chapter 8 Accounting for Share Capital

TS Grewal Accountancy Class 12 Solutions Chapter 8 Accounting for Share Capital are part of TS Grewal Accountancy Class 12 Solutions. Here we have given TS Grewal Accountancy Class 12 Solutions Chapter 8 Accounting for Share Capital.

| Board | CBSE |

| Textbook | NCERT |

| Class | Class 12 |

| Subject | Accountancy |

| Chapter | Chapter 8 |

| Chapter Name | Accounting for Share Capital |

| Number of Questions Solved | 91 |

| Category | TS Grewal Solutions |

TS Grewal Accountancy Class 12 Solutions Chapter 8 Accounting for Share Capital

Question 1.

Gopal Ltd. was registered with an authorised capital of ₹ 50,00,000 divided into Equity Shares of ₹ 100 each. The company offered for public subscription all the shares. Public applied for 45,000 shares and allotment was made to all the applicants. All the calls were made and were duly received except the final call of ₹ 20 per share on 500 shares.

Prepare the Balance Sheet of the company showing the different types of share capital.

Solution:

Question 2.

Himmat Ltd has authorised share capital of ₹ 50,00,000 divided into 5,00,000 Equity Shares of ₹ 10 each. It has existing issued and paid up capital of ₹ 5,00,000. It further issued to public 1,50,000 Equity Shares at par for subscription payable as under:

The issue was fully subscribed and allotment was made to all the applicants. Call was made during the year and was duly received.

Show share capital of the company in the Balance Sheet of the Company.

Solution:

Question 3.

Lennova Ltd. has authorised share capital of ₹ 1,00,00,000 divided into 1,00,000 Equity Shares of ₹ 100 each. It has existing issued and paid up capital of ₹ 25,00,000. It further issued to public 25,000 Equity Shares at a premium of 20% for subscription payable as under:

On Application: ₹ 30

On Allotment: ₹ 60 and

On Call: Balance Amount.

The issue was fully subscribed and allotment was made to all the applicants. The company did not make the call during the year.

Show share capital of the company in the Balance Sheet of the Company.

Solution:

Question 4.

A company issued 2,50,000 Equity Shares of ₹ 10 each to public. All amounts have been received in lump sum. Pass necessary journal entries in the books of the company.

Solution:

Question 5.

The authorised capital of ₹ 16,00,000 of XYZ Ltd. is divide into 1,60,000 Equity Shares of ₹ 10 each. Out of these shares 80,000 Equity Shares were issued at par to public for subscription. The full nominal value is payable on application. All the shares were subscribed by the public and total amount was paid for Pass necessary journal entries in the books of the company.

Solution:

Question 6.

XYZ Ltd. invited applications for 10,000 shares of ₹ 100 each payable as follows:

₹ 20 on application, ₹ 30 on allotment, ₹ 20 on first call and the balance on final call.

All the shares were applied and allotted. All the money was duly received.

You are required to journalise these transactions.

Solution:

Question 7.

Marigold Ltd. was registered with the authorized capital of ₹ 3,00,000 divided into 3,000 shares of ₹ 100 each, which were offered to the public Amount payable as ₹ 30 per share on application, ₹ 40 per share on allotment and ₹ 30 per share on first and final call. These shares were fully subscribed and all money was dully received. Prepare journal and Cash Book.

Solution:

Question 8.

A company was registered with an authorised capital of ₹ 10,00,000 divided into 7,500 Equity Shares of ₹ 100 each and, 2,500 Preference Shares of ₹ 100 each. 1,000 Equity and 500; 9% Preference Shares were offered to public on the following terms-

Equity Shares payable

₹ 10 on application, ₹ 40 on allotment and the balance in two calls of ₹ 25 each. Preference Shares are payable ₹ 25 on application, ₹ 25 on allotment and ₹ 50 on first and final call. All the shares were applied for and allotted. Amount due was duly received. Prepare Cash Book and pass necessary journal entries to record the above issue of shares and show how the Share Capital will appear in the Balance Sheet.

Solution:

Question 9.

Shiva Ltd. issued 1,00,000 Equity Shares of ₹ 10 each at a premium of ₹ 5 per share. The whole amount was payable on application. The issue was fully subscribed. Pass necessary Journal entries.

Solution:

Question 10.

A limited company offered for subscription 10,000 shares of ₹ 25 each, payable ₹ 5 per share on application, ₹ 10 per share on allotment (including ₹ 5 per share as premium), ₹ 5 per share as first call on the shares and the balance in two equal amounts at intervals of three months. All the shares were applied for and allotted. All the money was received except the second call and final call on 200 and 400 shares respectively.

You are asked to show the entries in the company’s Journal, Cash Book and the ledger. Also show the company’s Balance Sheet oncompletion of the above transaction.

Solution:

Question 11.

X Ltd. was incorporated with a capital of ₹ 2,00,000 divided into shares of ₹ 10 each. 2,000 shares were offered to the public and out of these 1,800 shares were applied for and allotted ₹ 3 per share (including ₹ 1 premium) was payable on application, ₹ 4 per share (including ₹ 1 premium) on allotment, ₹ 2 per share on first call and ₹ 3 per share on final call. All the money was received. Give necessary journal entries and the Balance Sheet.

Solution:

Question 12.

Authorized capital of Suhani Ltd. is ₹ 45,00,000 divided into 30,000 shares of ₹ 150 each. Out of these company issued 15,000 shares of ₹ 150 each at a premium of ₹ 10 per share. the amount was payable as follows:

₹ 50 per share on application, ₹ 40 per share on allotment (including premium), ₹ 30 per share on firs t call and balance on final call. Public applied for 14,000 shares. All the money was duly received .

Prepare an extract of Balance Sheet of Suhani Ltd . as per Schedule III, Part I of the companies Act, 2013 disclosing the above information. Also prepare Notes to Accounts for the same.

Solution:

Question 13.

SRCC Ltd. was registered with a capital of ₹ 25,00,000 in shares of ₹ 10 each. It issued a prospectus inviting applications for 25,000 shares at 40% premium payable as follows:

On application ₹ 5 (including ₹ 1 premium), on Allotment ₹ 4 (including ₹ 1 premium), on first call ₹ 3 (including ₹ 1 premium), on second and final call ₹ 2 (including ₹ 1 premium).

Applications were received for 25,000 shares. All money was duly received. Pass the necessary Journal entries.

Solution:

Question 14.

X Ltd. invited application for 10,000 Equity Shares of ₹ 10 each issued at per The amount was payable on application. The issue was oversubscribed by 2,000 shares and allotment was made on pro rata basis. Pass necessary Journal entries.

Solution:

Question 15.

Citizen Watches Ltd. invited applications for 50,000 shares of ₹ 10 each payable ₹ 3 on application, ₹ 4 on allotment and balance on first and final call . Applications were received for 60,000 shares. Applications were accepted for 50,000 shares and remaining applications were rejected. All calls were made and received except First and Final call on 500 shares.

Pass the journal entries in the books of Citizen Watches Ltd .

Solution:

Question 16.

ABC Company Ltd.offered for subscription 20,000 shares of ₹ 10 each payable ₹ 3 on application and ₹ 5 on allotment for each share. Applications were received for 30,000 shares. Letters of regret were issued to applicants for 5,000 shares and their application money was refunded.

Application money for other 5,000 shares was applied towards the payment for allotment money. The balance of allotment money was also received in due time.

You are to prepare the journal, Cash Book, Ledger Accounts and the Balance Sheet of the company.

Solution:

Question 17.

Eastern Company Limited having an authorised capital of ₹ 10,00,000 divided into shares of ₹ 10 each, issued 50,000 shares at a premium of ₹ 3 per share payable as follows:

Applications were received for 60,000 shares and the directors allotted the shares as follows:

(i) Applicants for 40,000 shares received in full.

(ii) Applicants for 15,000 shares received an allotment of 8,000 shares.

(iii) Applicants for 5,000 shares received 2,000 shares on allotment, excess money being returned.

All amounts due on allotment were received.

The first call was made and the money was received except on 100 shares.

Give journal and cash book entries to record these transactions of the company. Also prepare the Balance Sheet of the company.

Solution:

Question 18.

X company issued ₹ 10,00,000 shares for subscription of ₹ 100 each at a premium of ₹ 20 per share payable as:

₹ 10 per share on application,

₹ 40 per share and ₹ 10 premium on allotment, and

₹ 50 per share and ₹ 10 premium on final payment.

Over-payments on application were to be applied towards amount due on allotment and over-payments on application exceeding amount due on allotment was to be returned. Issue was oversubscribed to the extent of 13,000 shares. Applicants for 12,000 shares were allotted only 1,000 shares and applicants for 2,000 shares were sent letters of regret. All the money due on allotment and final call was duly received.

Pass necessary entries in the company’s books to record the above transactions. Also, prepare company’s Balance Sheet on completion of the above transactions.

Solution:

Question 19.

Sugandh Ltd. issued 60,000 shares of ₹ 10 each at a premium of ₹ 2 per share payable as ₹ 3 on application, ₹ 5(including premium) on allotment and the balance on first and final call. Applications were received for 92,000 shares. The Directors resolved to allot as:

Mohan, who had applied for 800 shares in Category

(i) and Sohan, who was allotted 600 shares in Category

(ii) failed to pay the allotment money. Calculate amount received on allotment.

Solution:

Question 20.

Sony Media Ltd.issued 50,000 shares of ₹ 10 each payable ₹ 3 on application, ₹ 4 on allotment and balance on first and final call. Applications were received for 1,00,000 shares and allotment was made as follows:

(i) Applicants for 60,000 shares were allotted 30,000 shares,

(ii) Applicants for 40,000 shares were allotted 20,000 shares,

Anupam to whom 1,000 shares were allotted from category

(i) failed to pay the allotment money.

Pass journal entries up to allotment.

Solution:

Question 21.

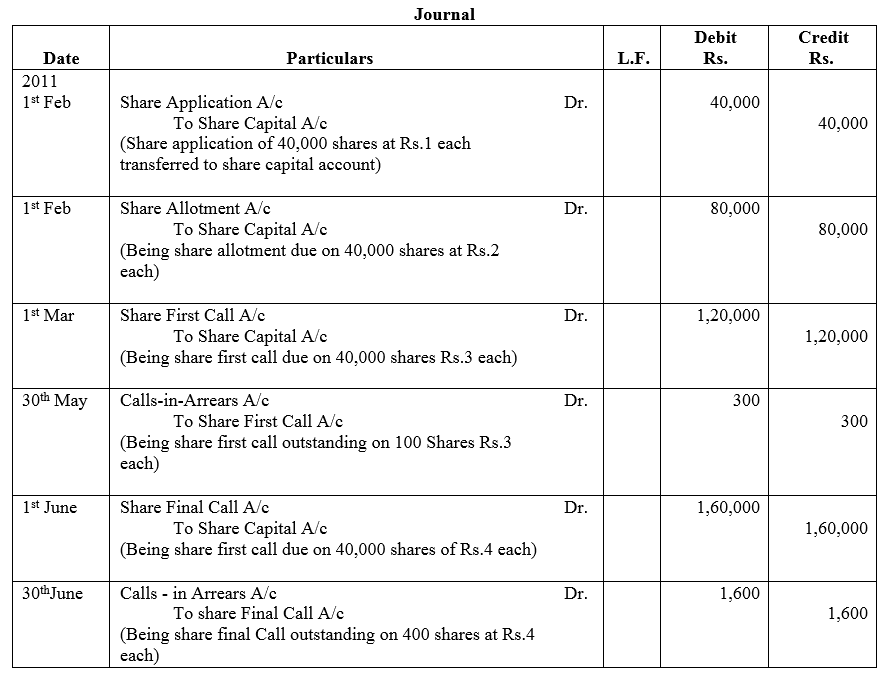

The Kalyan Cotton Mills Ltd.was registered on 1st January, 2011 with a capital of ₹10,00,000 divided into 1,00,000 shares of ₹ 10 each. The company issued 42,000 shares of which 40,000 shares were taken up by the public and ₹ 1 per share was received with application. On 1st February, these shares were allotted and ₹ 2 per share was duly received on 28th February as allotment money. A first call of ₹ 3 per share was made on 1st March and the call money on all shares with the exception of 100 shares was received. The final call of ₹ 4 per share was made on 1st June and the amount due, with the exception of 400 shares was received by 30th June. Pass necessary journal ands Cash Book entries and prepare the Balance Sheet as at 30th June, 2011.

Solution:

Question 22.

Ghosh Ltd. made the second and final call on its 50,000 Equity Shares @ ₹ 2 per share on 1st January, 2016. The entire amount was received on 15th January, 2016 except on 100 shares allotted to Venkat. Pass necessary journal entries for the call money due and received by opening Calls-in-Arrears Account.

Solution:

Question 23.

A Ltd was registered with a capital of ₹ 5,00,000 in shares of ₹ 10 each and issued 20,000 such shares at a premium of ₹ 2 per share payable as ₹ 2 per share on application, ₹ 5 per share on allotment (including premium) and ₹ 2 per share on first call made three months later. All the money payable on application and allotment was duly received but when the first call was made, one shareholder paid the entire balance on his holding of 300 shares and another shareholder holding 1,000 shares failed to pay the first call money.

Pass journal entries to record the above transactions and show how they will appear in the company’s Balance Sheet.

Solution:

Question 24.

XYZ Ltd.issued 8,000 Equity Shares of ₹ 10 each. ₹ 5 per share was called, payable ₹ 2 on application, ₹ 1 on allotment, ₹ 1 on first call and ₹ 1 on second call. All the money was duly received with the following exceptions:

A who holds 250 shares paid nothing after application.

B who holds 500 shares paid nothing after allotment.

C who holds 1,250 shares paid nothing after first call.

Prepare journal and the Balance Sheet.

Solution:

Question 25.

Bharat Ltd made the first call of ₹ 2 per share on its 1,00,000 Equity Shares on 1st March, 2006. Ashok, a shareholder, holding 800 shares paid the second and final call amount along with the first call money. The second and final call amount was ₹ 3 per share. Pass necessary journal entries for recording the above using the Calls-in Advance Account.

Solution:

Question 26.

2,000 Equity Shares of ₹ 10 each were issued to Limited from whom assets of ₹ 25,000 were acquired. Pass Journal entry.

Solution:

Question 27.

A limited company issued 800 Equity Shares of ₹ 100 each at a premium of 25% as fully paid-up in consideration of the purchase of plant and machinery of ₹ 1,00,000. Pass entries in company’s journal.

Solution:

Question 28.

Rajan Ltd. purchased assets from Geeta & Co. for ₹ 5,00,000. A sum of ₹ 1,00,000 was paid by means of a bank draft and for the balance due Rajan Ltd. issued equity Shares of ₹ 10 each at a premium of 25%. journalise the above transactions in the books of the company.

Solution:

Question 29.

Z Ltd. purchased furniture costing ₹ 2,20,000 from C.D Ltd. The payment was to be made by issue of 9% Preference Shares of ₹ 100 each at a premium of ₹ 10 per share. Pass necessary Journal entries in the books of Z Ltd.

Solution:

Question 30.

Goodluck Ltd purchased machinery costing ₹ 10,00,000 from Fair Deals Ltd. The company paid the price by issue of Equity Shares of ₹ 10 each at a premium of 25%. Pass necessary Journal entries for the above transactions in the books of Goodluck Ltd.

Solution:

Question 31.

Jain Ltd purchased machinery costing ₹ 10,00,000 from Ayer Ltd. 50% of the payment was made by cheque and for the remaining 50%, the company issued Equity Shares of ₹ 100 each at a premium of 25%. Pass necessary Journal entries in the books of Jain Ltd. for the above transaction.

Solution:

Question 32.

Sona Ltd. purchased machinery costing ₹ 17,00,000 from Mona Ltd. Sona Ltd. paid 20% of the amount by cheque and for the balance amount issued Equity Shares of ₹ 100 each at a premium of 25%. Pass necessary Journal entries for the above transactions in the books of Sona Ltd .Show your working notes clearly.

Solution:

Question 33.

Light Lamps Ltd. issued 50,000 shares of ₹ 10 each as fully paid-up to the promoters for their services to set-up the company. It also issued 2,000 shares of ₹ 10 each credited as fully paid-up to the underwriters of shares for their services. journalise these transactions.

Solution:

Question 34.

Better Prospect Ltd. acquired land costing ₹ 1,00,000 and in payment allotted 1,000 Equity Shares of ₹ 100 each as fully paid. Further, the company issued 4,000 Equity Shares to public. The shares were payable as: ₹ 30 on application; ₹ 30 on allotment; ₹ 40 on first and final call.

Applications were received for all shares which were allotted. All the money was received except the call on 200 shares.

Pass journal entries and prepare Balance Sheet of the company.

Solution:

Question 35.

A company issued 30,000 fully paid-up shares of ₹ 100 each for purchase of the following assets and liabilities from Sharma Co:

You are required to pass necessary journal entries.

Solution:

Question 36.

A company purchased a running business from M/s. Rai Brothers for a sum of ₹ 15,00,000 payable ₹ 12,00,000 in fully paid shares of ₹ 10 each and balance through cheque.

The assets and liabilities consisted of the following:

You are required to pass necessary journal entries in the company’s books.

Solution:

Question 37.

Sandesh Ltd. took over the assets of ₹ 7,00,000 and liabilities of ₹ 2,00,000 from Sanchar Ltd. for a purchase consideration of ₹ 4,59,500. ₹ 8,500 were paid by accepting a draft in favour of Sanchar Ltd. payable after three months and the balance was paid by issue of equity shares of ₹ 10 each at a premium of 10% in favour of Sanchar Ltd.

Pass necessary journal entries for the above transactions in the books of Sandesh Ltd.

Solution:

Question 38.

Z Ltd. issued 20,000 Equity Shares of ₹ 10 each at par payable: On application ₹ 2 per share; on allotment ₹ 3 per share; on first call ₹ 3 per share; on second and final call ₹ 2 per share.

Mr Gupta was allotted 100 shares. Pass necessary journal entry relating to the forfeiture of shares in each of the following alternative cases:

Case I: If Mr Gupta failed to pay the allotment money and his shares were forfeited.

Case II: If Mr Gupta failed to pay allotment money and on his subsequent failure to pay the first call his shares were forfeited.

Case III: If Mr Gupta failed to pay the first call and on his subsequent failure to pay the second and final call, his shares were forfeited.

Solution:

Question 39.

A Co Ltd. was registered with a nominal capital of ₹ 1,00,000 in Equity Shares of ₹ 10 each. It offered to the public 6,000 shares for subscription. The applications were received for 8,000 shares. The Directors rejected applications for 1,000 shares and returned the money received thereon. The application money received on the other 1,000 shares was adjusted towards allotment money. The amount payable on shares was: ₹ 2 per share on application, ₹ 4 per share on allotment and the balance on first call. One shareholders holding 100 shares failed to pay the first call money and as a result his shares were forfeited.

Pass necessary journal entries and prepare Cash Book to record the above transactions.

Solution:

Question 40.

U.P. Sugar Works Ltd. was registered on 1st January, 2014 with an authorised capital of ₹ 15,00,000 divided into 15,000 shares of ₹ 100 each. The company issued on 1st April, 2014, 5,000 shares of ₹ 100 each at a premium of ₹ 5 per share payable ₹ 25 per share on application, ₹ 30(including premium) on allotment and the balance in two equal installments of ₹ 25 each on 1st July ad 1st October respectively. All the allotments and call moneys were paid when due except in case of one shareholder who failed to pay the final call on 100 shares held by him. His shares were forfeited on 1st November after giving him a due notice. Show necessary entries in the books of the company to record these transactions.

Solution:

Question 41.

A company issued 10,000 Equity Shares of ₹ 10 each at a premium of ₹ 3 per share payable ₹ 5 on application, ₹ 5 (including premium) on allotment and the balance on first call. All the shares offered were applied for and allotted. All the money due on allotment was received except on 200 shares. Call was made. All the amount due thereon was received except on 300 shares. Directors forfeited 200 shares on which both allotment and call money were not received.

Pass necessary journal entries to record the above.

Solution:

Question 42.

A company issued 10,000 shares of the value of ₹ 10 each, payable ₹ 3 on application, ₹ 3 on allotment and ₹ 4 on the first and final call. All amounts are duly received except the call money on 100 shares. These shares are subsequently forfeited by Directors and are resold as fully paid-up for ₹ 500.

Give necessary journal entries for the transactions.

Solution:

Question 43.

X Ltd. forfeited 900 Equity Shares of ₹ 100 each for the non-payment of allotment money of ₹ 30 per share and the first call of ₹ 20 per share. The second and final call of ₹ 25 per share has not been made. The forfeited shares were reissued for ₹ 90 per share, ₹ 75 paid-up. Journalise the above.

Solution:

Question 44.

The Directors of M Ltd resolved on 1st May, 2015 that 2,000 Equity Shares of ₹ 10 each, ₹ 7.50 paid be forfeited for non-payment of final call of ₹ 2.50. On 10th June, 2015, ₹ 1,800 of these shares were reissued for ₹ 6 per share. Give necessary Journal entries.

Solution:

Question 45.

Super Star Ltd. makes an issue of 10,000 Equity Shares of ₹ 100 each, payable as:

On application and allotment ₹ 50 per share

On first call ₹ 25 per share

On second and final call ₹ 25 per share.

Members holding 400 shares did not pay the second and final call and the shares are duly forfeited, 200 of which are reissued as fully paid-up @ ₹ 50 per share. Pass journal entries in the books of the company.

Solution:

Question 46.

A company issued 20,000 shares of ₹ 100 each payable ₹ 25 per share on application, ₹ 25 per share on allotment and the balance in two calls of ₹ 25 each. The company did not make the final call of ₹ 25 per share. All the money was duly received with the exception of the amount due on the first call on 400 shares held by Mr. Modi. The Board of Directors forfeited these shares and subsequently reissued them @ ₹ 75 per share paid-up for a sum of ₹ 28,000. journalise the above transactions and prepare Share Capital Account.

Solution:

Question 47.

The Hindustan Manufacturing Ltd. had a total subscribed capital of ₹ 10,00,000 in Equity Shares of ₹ 10 each of which ₹ 7.50 were called-up. A final call of ₹ 2.50 was made and all amount paid except two calls of ₹ 2.50 each in respect of 100 shares held by D. These shares were forfeited and reissued at ₹ 8 per share.

Pass necessary journal entries (including that of cash) to record the transactions of final call forfeiture of shares and reissue of forfeited shares. Also, prepare the Balance Sheet of the company.

Solution:

Question 48.

On 1st May, 2014, Directors of a Limited Company forfeited 200 shares of ₹ 20 each, ₹ 15 per share called-up, on which ₹ 10 per share has been paid by the amount of the first call of ₹ 5 per share being unpaid. Ten days Later, the Directors reissued the forfeited shares to B credited as ₹ 15 per share paid-up, for a payment of ₹ 10 per share.

Give journal entries in the company’s books to record the forfeited shares and their reissue.

Solution:

Question 49.

X Ltd. forfeited 100 shares of ₹ 10 each (₹ 8 called-up) issued at a premium of ₹ 2 per share to Mr. R on which he had paid applications money of ₹ 5 per share, for non-payment of allotment money of ₹ 5 per share (including premium). Out of these, 70 shares were reissued to Mr . Sanjay as ₹ 8 called-up for ₹ 7 per share. Give necessary journal entries relating to forfeiture and reissue of shares.

Solution:

Question 50.

A Limited Company forfeited 100 Equity Shares of the face value of ₹ 10 each, ₹ 6 per share called-up, for non-payment of first call of ₹ 2 per share. The forfeited shares were subsequently reissued as fully paid-up @ ₹ 7 each.

Give necessary entries in the company’s journal.

Solution:

Question 51.

Give necessary journal entries:

(i) The Directors of Devendra Ltd. resolved on 1st January, 2010 that Equity Shares of ₹ 10 each, ₹ 8 paid-up be forfeited for non-payment of final call of ₹ 2. On 1st February, 60 of these shares were reissued @ ₹ 7 per share as fully paid-up.

(ii) Virender Limited forfeited 20 shares of ₹ 100 each(₹ 60 called-up) issued at par to Mukesh on which he had paid ₹ 20 per share. Out of these, 15 shares were reissued to Sanjeev as ₹ 60 paid-up for ₹ 45 per share.

Solution:

Question 52.

Show the forfeiture and reissue entries under each of the following cases:

(i) X Ltd. forfeited 300 shares of ₹ 10 each, ₹ 8 called-up held by Mr. A for non-payment of second call money of ₹ 3 per share. These shares were reissued to Mr. Z for ₹ 10 per share as fully paid-up.

(ii) Y Ltd. forfeited 400 shares of ₹ 10 each, fully called-up, held by Mr. B for non-payment of final call money of ₹ 4 per share. These shares were reissued to Mr. T at ₹ 12 per share as fully paid-up.

(iii) Z Ltd. forfeited 250 shares of ₹ 10 each, fully called-up held by Mr. C for non-payment of allotment @ ₹ 8 per share as fully paid-up to Mr. P.

Solution:

Question 53.

Record the journal entries for forfeiture and reissue of shares in the following cases:

(i) X Ltd. forfeited 20 shares of ₹ 10 each, ₹ 7 called-up on which the shareholder had paid application and allotment money of ₹ 5 per share. Out of these, 15 shares were reissued to Naresh as ₹ 7 per share paid-up for ₹ 8 per share.

(ii) Y Ltd. forfeited 90 shares of ₹ 10 each, ₹ 8 called-up issued at a premium of ₹ 2 per share to R for non-payment of allotment money of ₹ 5 per share (including premium). Out of these, 80 shares were reissued to Sanjay as ₹ 8 called-up for ₹ 10 per share.

Solution:

Question 54.

Star Ltd. forfeited 500 Equity Shares of ₹ 100 each for non-payment of first call of ₹ 30 per share. The final call of ₹ 10 per share was not yet made. Out of these, 60% shares were reissued for ₹ 39,000 fully paid. journalise the forfeiture and reissue of shares.

Solution:

Question 55.

A holds 100 shares of ₹ 10 each on which he has paid ₹ 1 per share on application.

B holds 200 shares of ₹ 10 each on which he has paid ₹ 1 and ₹ 2 per share on application and allotment respectively.

C holds 300 shares of ₹ 10 each and has paid ₹ 1 on application, ₹ 2 on allotment and ₹ 3 on first call. They all fail to pay their arrears and the second call of ₹ 2 per share. Shares are forfeited and subsequently reissued @ ₹ 11 per share as fully paid-up.

journalise the above.

Solution:

Question 56.

A Ltd. company with registered capital of ₹ 5,00,000 in shares of ₹ 10 each issued 20,000 of such shares payable ₹ 2 on application, ₹ 4 on allotment, ₹ 2 on final call . All the money payable on allotment was duly received but on the first call being made, one shareholder paid the entire balance on his holding of 300 shares and five shareholders with a total holding of 1,000 shares failed to pay their dues on the first call. These shares were forfeited for non-payment of first call money. Final call was made and all the money due was received. Later on, forfeited shares were reissued @ ₹ 6 per share as fully paid-up.

Record the above in the company’s journal and prepare the Balance Sheet.

Solution:

Question 57.

New Company Ltd. has a nominal capital of ₹ 2,50,000 in shares of ₹ 10. Of these, 4,000 shares were issued as fully paid in payment of building purchased, 8,000 shares were subscribed by the public and during the first year ₹ 5 per share were called-up, payable ₹ 2 on application, ₹ 1 on allotment, ₹ 1 on first call and ₹ 1 on second call. The amounts received in respect of these shares were:

The Directors forfeited the 750 shares on which less than ₹ 4 had been paid. The shares were subsequently reissued at ₹ 3 per share.

Pass journal entries recording the above transactions and prepare the company’s Balance Sheet.

Solution:

Question 58.

X Ltd. invited applications for 10,000 Equity Shares of ₹ 10 each for public subscription. The amount of these shares was payable as:

On application ₹ 1 per share, on allotment ₹ 2 per share, on first call ₹ 3 per share and on second and final call ₹ 4 per share.

All sums payable on application, allotment and calls were duly received with the following exceptions:

(i) A, who held 200 shares, failed to pay the money on allotments and calls.

(ii) B to whom 150 shares were allotted, failed to pay the money on first call and final call.

(iii) C, who held 50 shares did not pay the amount of second and final call.

The shares of A, B and C were forfeited and were subsequently reissued for cash as fully paid-up at a discount of 5%.

Pass necessary journal entries to record these transactions in the books of X Ltd.

Solution:

Question 59.

A share of ₹ 100 issued at a premium of ₹ 10 on which ₹ 80 (including premium) was called and ₹ 60 (including premium) was paid, has been forfeited. This share was afterwards reissued as fully paid-up for ₹ 70. Give Journal entries to record the above.

Solution:

Question 60.

Pass journal entries in the following cases:

M Ltd. forfeited 200 Equity Shares of ₹10 each issued at a premium of ₹ 5 per share, held by Ram for non-payment of the final call of ₹ 3 per share. Of these, 100 shares were reissued to Vishu at a discount of ₹ 4 per share.

Solution:

Question 61.

VT Ltd forfeited 200 shares of ₹ 10 each, issued at a premium of ₹ 5 per share, held by Mohan for non-payment of the final call of ₹ 3 per share. 100 out of these shares were reissued to Narendra at a discount of ₹ 4 per share. Journalise.

Solution:

Question 62.

The Directors of a company forfeited 300 shares of ₹ 10 each issued at a premium of ₹ 3 per share, for the non-payment of the first call money of ₹ 2 per share. The final call of ₹ 2 per share has not been made. Half the forfeited shares were reissued at ₹ 1,500 as fully paid-up. Record the journal entries for the forfeiture and reissue of shares.

Solution:

Question 63.

JCV Ltd., forfeited 200 shares of ₹ 10 each issued at a premium of ₹ 2 per share for the non-payment of allotment money of ₹ 3 per share (including premium). The first and final call of ₹ 4 per share has not been made as yet. 50% of the forfeited shares were reissued at ₹ 8 per share as fully paid-up. Pass necessary Journal entries for the forfeiture and reissue of shares.

Solution:

Question 64.

Pass necessary journal entries in the books of the company for the following transactions:

Vishesh Ltd. forfeited 1,000 Equity Shares of ₹ 10 each issued at a premium of ₹ 2 per share for non-payment of allotment money of ₹ 5 per share including premium. The final call of ₹ 2 per share was not yet called on these shares. Of the forfeited shares 800 shares were reissued at ₹ 12 per share as fully paid-up.

The remaining shares were reissued at ₹ 11 per share fully paid-up.

Solution:

Question 65.

150 shares of ₹ 10 each issued at a premium of ₹ 4 per share payable with allotment were forfeited for non-payment of allotment money of ₹ 8 per share including premium. The first and final call of ₹ 4 per Pass Journal entries in the books of X Ltd. for the above.

Solution:

Question 66.

Commence Publications Ltd. issued 50,000 Equity Shares of ₹ 10 each at a premium of 10% payable as under:

The calls were made by the company and all the money was duly received except the allotment and call money on 500 shares. These shares were, therefore, forfeited and later reissued @ ₹ 9 per share as fully paid-up.

Pass necessary journal entries to record the above transactions.

Solution:

Question 67.

Gaurav applied for 5,000 shares of ₹ 10 each at a premium of 2.50 per share. But he was allotted only 2,500 shares on pro rata basis. After having paid ₹ 3 per share on application, he did not pay allotment money of ₹ 4.50 per share (including premium) and on his subsequent failure to pay the first call of ₹ 2 per share, his shares were forfeited. These shares were reissued at the rate of ₹ 8 per share credited as fully paid.

Pass journal entries to record the forfeiture and reissue of shares.

Solution:

Question 68.

A Ltd issued 20,000 Equity Shares of ₹ 10 each at a premium of ₹ 5 per share, payable as ₹ 7 (including premium) on application, ₹ 5 on allotment and the balance after three months of allotment.

A shareholder to whom 200 shares were allotted failed to pay the allotment and call money and his shares were forfeited. 160 of the forfeited shares were reissued for ₹ 1,600.

Give necessary entries in company’s journal and the Balance Sheet.

Solution:

.

.

Question 69.

Kamal Ltd. was formed on 1st April, 2010 with an authorised capital of ₹ 2,00,000, divided into 2,000 Equity Shares of ₹ 100 each. 1,000 shares were issued as fully paid to the vendors of building for payment of the purchase consideration. The remaining 1,000 shares were offered or public subscription at a premium of ₹ 5 per share payable as:

Applications were received for 900 shares which were duly allotted and the allotment money was received in full. At the time of the first call, a shareholder who held 100 shares failed to pay the first call money and his shares were forfeited. These shares were reissued @ ₹ 60 per share, ₹ 70 per share paid-up.

Final call has not been made.

You are required to

(i) give necessary journal entries to record the above transactions and

(ii) show how share capital would appear in the Balance Sheet of the company.

Solution:

Question 70.

Krishna & Co. Ltd. with an authorised capital of ₹ 2,00,000 divided into 20,000 Equity Shares of ₹ 10 each, issued the entire amount of the shares payable as:

₹ 5 on application (including premium ₹ 2 per share),

₹ 4 on allotment, and

₹ 3 on call.

All share money is received in full with the exception of the allotment money on 200 shares and the call money on 500 shares (including the 200 shares on which the allotment money has not been paid).

The above 500 shares are duly forfeited and 400 of these( including the 200 shares on which allotment money has not been paid) are reissued at ₹ 7 per share payable by the purchaser as fully paid-up. Pass journal entries(including cash transactions) and show the balances in the Balance Sheet giving effect to the above transactions.

Solution:

Question 71.

Midee Ltd. invited applications for issuing 27,000 shares of ₹ 100 each payable as follows:

₹ 50 per share on application;

₹ 10 per share on allotment; and

Balance on First and Final call.

Applications were received for 40,000 shares. Full allotment was made to the applicants of 7,000 shares. The remaining applicants were allotted 20,000 shares on pro rata basis. Excess money received on applications was adjusted towards allotment and call.

Asha, holding 600 shares was belonged to the category of applicants to whom full allotment was made, paid the call money at the time of allotment. Ankur, who belonged to the category of applicants to whom shares were allotted on pro rata basis did not pay anything after application on his 200 shares. Ankur’s shares were forfeited after the First and Final call. These shares were later reissued at ₹ 105 per share as fully paid-up.

Pass necessary journal entries in the books of Midee Ltd. for the above transactions, by opening Calls-in-Arrears and Calls-in-Advance Accounts wherever necessary.

Solution:

Question 72.

VXN Ltd. invited applications for issuing 50,000 equity shares of ₹ 10 each at a premium of ₹ 8 per share. The amount was payable as follows:

The issue was fully subscribed. Gopal, a shareholder holding 200 shares, did not pay the allotment money and Madhav, a holder of 400 shares, paid his entire share money along with the allotment money. Gopal’s shares were immediately forfeited after allotment. Afterwards, the first call was made. Krishna, a holder of 100 shares failed to pay the first call money and Girdhar, a holder of 300 shares, paid the second call money also along with the first call. Krishna’s shares were forfeited immediately after the first call. Second and final call was made afterwards and was duly received. All the forfeited shares were reissued at ₹ 9 per share fully paid-up.

Pass necessary journal entries for the above transactions in the books of the company.

Solution:

Question 73.

Sukanya Ltd. invited applications for issuing 1,00,000 equity shares of ₹ 10 each. The shares were issued at a premium of ₹ 20 per share. The amount was payable as follows:

Applications for 96,000 shares were received. Rohit, a shareholder holding 7,000 shares, failed to pay both the calls and Namit a holder of 5,000 shares, did not pay the final call.

Shares of Rohit and Namit were forfeited. Of the forfeited shares 8,000 shares including all the shares of Rohit were reissued to Reena at ₹ 8 per share fully paid-up.

Pass necessary journal entries for the above transactions in the books of Sukanya Ltd.

Solution:

Question 74.

Alfa Ltd. invited applications for issuing 75,000 equity shares of ₹ 10 each. The amount was payable as follows:

Applications for 1,00,000 shares were received. Shares were allotted to all the applicants on pro rata basis and excess money received with applications was transferred towards sums due on first call. Vibha who was allotted 750 shares failed to pay the first call. Her shares were immediately forfeited. Afterwards the second call was made. The amount due on second call was also received except on 1,000 shares applied by Monika. Her shares were also forfeited. All the forefited shares were reissued to Mohit for ₹9,000 as fully paid-up.

Pass necessary journal entries in the Books of Alfa Ltd. for the above transactions.

Solution:

Question 75.

Himalaya Company Limited issued for public subscription 1,20,000 equity shares of ₹ 10 each at a premium for ₹ 2 per share payable as under:

Applications were received for 1,60,000 shares. Allotment was made on pro rata basis. Excess money on application were adjusted against the amount due on allotment.

Rohan to whom 4,800 shares were allotted failed to pay for the two calls. These shares were subsequently forfeited after the second call was made. All the shares forfeited were reissued to Teena as fully paid at ₹ 7 per share.

Record journal entries and show the transactions relating to share capital in the company’s Balance Sheet.

Solution:

Question 76.

H Limited issued a prospectus inviting applications for 20,000 shares of ₹ 10 each at a premium of ₹ 2 per share payable as follows:

On application ₹ 2 ; on allotment ₹ 5 (including premium) ; on first call ₹ 3 ; on second and final call ₹ 2.

Applications were received for 30,000 shares and pro rata allotment was made on the applications for 24,000 shares. Money overpaid on applications was adjusted against amount due on allotment.

Ramesh, to whom 400 shares were allotted, failed to pay the allotment money and on his subsequent failure to pay first call his shares were forfeited . Mohan, the holder of 600 shares, failed to pay two calls and his shares were forfeited after the second call.

Of the shares forfeited, 800 shares were sold to Krishna credited as fully paid-up for ₹ 9 per share, the whole of Ramesh’s shares being included.

Pass journal entries and prepare the Balance Sheet.

Solution:

Question 77.

Dogra Ltd. had an authorised capital of ₹ 1,00,00,000 divided into Equity Shares of ₹ 100 each. The company offered 84,000 shares to the public at premium. The amount was payable as follow:

Applications were received for 80,000 shares.

All sums were duly received except the following:

Lakhan, a holder of 200 shares did not pay allotment and call money.

Paras, a holder of 400 shares did not pay call money.

The company, forfeited the shares of Lakhan and Paras. Subsequently the forfeited shares were reissued for ₹ 80 per share as fully paid-up. Show the entries for the above transactions in the Cash Book and journal of the company.

Solution:

Question 78.

Jeevan Dhara Ltd. invited applications for issuing 1,20,000 equity shares of ₹ 10 each at a premium of ₹ 2 per share. The amount was payable as follows:

Applications for 1,50,000 shares were received. Shares were allotted to all the applicants on pro rata basis. Excess money received on applications was adjusted towards sums due on allotment. All calls were made. Manu who had applied for 3,000 shares failed to pay the amount due on allotment and first and final call Madhur who was allotted 2,400 shares failed to pay the first and final call. Shares of both Manu and Madhur were forfeited. The forfeited shares were reissued at ₹ 9 per share as fully paid-up.

Pass necessary journal entries for the above transactions in the books of Jeevan Dhara Ltd.

Solution:

Question 79.

JJK Ltd. invited applications for issuing 50,000 equity shares of ₹ 10 each at par. The amount was payable as follows:

On Application ₹ 2 per share,

On Allotment ₹ 4 per share; and

On First and Final call Balance Amount.

The issue was oversubscribed three times. Applications for 30% shares were rejected and money refunded. Allotment was made to the remaining applicants as follows:

Excess money paid by the applicants who were allotted shares was adjusted towards sums due on allotment.

Deepak, a shareholder belonging to Category I , who had applied for 1,000 shares ,failed to pay the allotment money. Raju, a shareholder holding 100 shares, also failed to pay the allotment money. Raju belonged to Category II. Shares of both Deepak and Raju were forfeited immediately after allotment. Afterwards, first and final call was made and was duly received. The forfeited shares of Deepak and Raju were reissued at ₹ 11 per share fully paid-up.

Pass necessary journal entries for the above transactions in the books of company.

Solution:

Question 80.

Nitro Paints Ltd. invited applications for issuing 1,60,000 equity shares of ₹ 10 each at a premium of ₹ 3 per share. The amount was payable as follows:

Applications for 1,80,000 shares were received. Applications for 10,000 shares were rejected and pro rata allotment was made to the remaining applicants. Over payment received on application was adjusted towards sums due on allotment. All calls were made and were duly received except allotment and final call from Aditya who was allotted 3, 200 shares. His shares were forfeited. Half of the forfeited shares were reissued for ₹ 43,000 as fully paid-up.

Pass necessary journal entries for the above transactions in the books of Nitro Paints Ltd.

Solution:

Question 81.

Raja Ltd. invited applications for issuing 50,000 Equity Shares of ₹ 10 each. The amount was payable as follows:

Applications for 70,000 shares were received. Allotment was made to all applicants on pro rata basis. Excess money received on application was adjusted towards sums due on allotment. Ramesh, who had applied for 700 shares did not pay the allotment money and on his failure to pay the allotment money his shares were forfeited. Afterwards, the first and the final call was made. Adhar, who had been allotted 500 shares, did not pay the first and final call. His shares were also forfeited. Out of the forfeited shares 900 shares were reissued at ₹ 8 per share as fully paid-up. The reissued shares included all the shares of Ramesh.

Pass necessary journal entries for the above transactions in the books of the company.

Solution:

Question 82.

XYZ Ltd. is registered with an authorised capital of ₹ 2,00,000 divided into 2,000 shares of ₹ 100 each of which 1,000 shares were offered for public subscription at a premium of ₹ 5 per share, payable as:

Applications were received for 1,800 shares, of which applications for 300 shares were rejected outright; the rest of the application were allotted 1,000 shares on pro rata basis. Excess application money was transferred to allotment.

All the money was duly received except from Sundar, holder of 100 shares, who failed to pay allotment and first call money. His shares were later forfeited and reissued to Shyam at ₹ 60 per share ₹ 70 paid-up. Final call has not been made.

Pass necessary Journal entries and prepare Cash Book in the books of XYZ Limited.

Solution:

Question 83.

Prince Limited issued a prospectus inviting applications for 20,000 equity shares of ₹ 10 each at a premium of ₹ 3 per share payable as follows:

Applications were received for 30,000 shares and allotment was made on pro rata basis. Money overpaid on application s was adjusted to the amount due on allotment.

Mr. Mohit whom 400 shares were allotted, failed to pay the allotment money and the first call and his shares were forfeited after the first call. Mr. Joly, whom 600 shares were allotted failed to pay for the two calls and hence, his shares were forfeited.

Of the shares forfeited, 800 shares were reissued to Supriya as fully paid for ₹ 9 per share, the whole of Mr Mohit’s shares being included.

Solution:

Question 84.

XYZ Ltd. invited applications for issuing 50,000 Equity Shares of ₹10 each. The amount was payable as:

Applications were received for 75,000 shares and pro rata allotment was made as:

Applicants for 40,000 shares were allotted 30,000 shares on pro rata basis.

Applicants for 35,000 shares were allotted 30,000 shares on pro rata basis.

Ramu, to whom 1,200 shares were allotted out of the group applying for 40,000 shares, failed to pay the allotment money. His shares were forfeited immediately after allotment.

Shamu, who had applied for 700 shares out of the group applying for 35,000 shares, failed to pay the first and final call. His shares were also forfeited. Out of the forfeited shares, 1,000 shares were reissued @ Applicants for 40,000 shares were allotted 30,000 shares on pro rata basis. 8 per share as fully paid-up. The reissued shares included all the forfeited shares of Shamu.

Pass necessary Journal entries to record the above transactions.

Solution:

Question 85.

A company issued for public subscription 40,000 Equity Shares of ₹ 10 each at a premium of ₹ 2 per share payable as:

Applications were received for 60,000 shares. Allotment was made on pro rata basis to the applicants for 48,000 shares, the remaining applications being refused. Money overpaid on application was utilised towards sums due on allotment. Ram to whom 1,600 shares were allotted failed to pay the allotment money and Shyam to whom 2,000 shares were allotted failed to pay the two calls. These shares were subsequently forfeited after the second and final call was made. All the forfeited shares were reissued as fully paid-up @ ₹ 8 per share.

Give necessary Journal entries for the above transactions.

Solution:

Question 86.

X Ltd. issued a prospectus inviting applications for 50,000 Equity Shares of ₹ 10 each, payable ₹ 5 as per application (including ₹ 2 as premium), ₹ 4 as per allotment and the balance towards first and final call.

Applications were received for 65,000 shares. Application money received on 5,000 shares was refunded with letter of regret and allotments were made on pro rata basis to the applicants of 60,000 shares. Money overpaid on applications including premium was adjusted on account of sums due on allotment.

Mr Sharma to whom 700 shares were allotted failed to pay the allotment money and his shares were forfeited by the Directors on his subsequently failure to pay the call money.

All the forfeited shares were subsequently sold to Mr.Jain credited as fully paid-up for ₹ 9 per share.

You are required to set out the journal entries and the relevant entries in the Cash Book.

Solution:

Question 87.

Super Star Ltd. issued a prospectus inviting applications for 2,000 shares of ₹ 10 each at a premium of ₹ 2 per share payable as:

Applications were received for 3,000 shares and pro rata allotment was made on the applications for 2,400 shares. It was decided to utilise excess application money towards the amount due on allotment.

Ramesh, to whom 40 shares were allotted, failed to pay the allotment money and on his subsequent failure to pay the first call, his shares were forfeited.

Rajesh, who applied for 72 shares failed to pay the two calls and on such failure, his shares were forfeited.

Of the shares forfeited, 80 shares were sold to Krishan credited as fully paid-up for ₹ 9 per share, the whole of Ramesh’s shares being included.

Give journal entries to record the above transactions (including cash transactions).

Solution:

Question 88.

Bharat Ltd. invited applications for issuing 2,00,000 Equity Shares of ₹ 10 each. The amount was payable as:

On application ₹ 3 per share, on allotment ₹ 5 per share and on first and final call ₹ 2 per share. Applications for 3,00,000 shares were received and pro rata allotment was made to all the applicants on the following basis:

Applicants for 2,00,000 shares were allotted 1,50,000 shares on pro rata basis.

Applicants for 1,00,000 shares were allotted 50,000 shares on pro rata basis.

Bajaj, who was allotted 3,000 shares out of group applying for 2,00,000 shares failed to pay the allotment money. His shares were forfeited immediately after allotment. Sharma, who had applied for 2,000 shares out of the group applying for 1,00,000 shares failed to pay the first and final call. His shares were also forfeited.

Out of the forfeited shares 3,500 shares were reissued as fully paid-up @ ₹ 8 per share. The reissued shares included all the forfeited shares of Bajaj.

Give necessary journal entries to record the above transactions.

Solution:

Question 89.

Amrit Ltd. issued 50,000 shares of ₹ 10 each at a premium of ₹ 2 per share payable as ₹ 3 on application, ₹ 4 on allotment (including premium), ₹ 2 on first call and the remaining on second call.

Applications were received for 75,000 shares and pro rata allotment was made to all the applicants.

All moneys due were received except allotment and first call from Sonu who applied for 1,200 shares. All his shares were forfeited. The forfeited shares were reissued for ₹ 9,600. Final call was not made. Pass necessary Journal entries.

Solution:

Question 90.

The Directors of Super Star Ltd. invited applications for 2,00,000 Equity Shares of ₹ 10 each to be issued at 20% premium. The money payable per shares was: on application ₹ 5 , O allotment ₹ 4 (including premium of ₹ 2), first call ₹ 2 and final call ₹ 1.

Applications were received for 2,40,000 shares and allotment was made as:

(i) to applicants for 1,00,000 shares in – full,

(ii) to applicants for 80,000 shares – 60,000 shares,

(iii) to applicants for 60,000 shares – 40,000 shares.

Applicants of 1,000 shares falling in Category

(i) and applicants of 1,200 shares falling in Category

(ii) failed to pay allotment money. These shares were forfeited on failure to pay first call. Holders of 1,200 shares falling in Category

(iii) failed to pay the first and final call and these shares were forfeited after final call.

1,300 shares [1,000 of Category(i) and 300 of Category (ii)] were reissued at ₹ 8 per share as fully paid-up.

Journalise the above transactions. Prepare Cash book and Balance Sheet.

Solution:

Question 91.

XYZ Ltd. issued a prospectus inviting applications for 2,000 shares of ₹ 10 each at a premium of ₹ 4 per share payable as:

On application – ₹ 6 (including ₹ 1 premium)

On allotment – ₹ 2 (including ₹ 1 premium)

On first call – ₹ 3 (including ₹ 1 premium)

On second and final call – ₹ 3 (including ₹ 1 premium)

Applications were received for 3,000 shares and pro rata allotment was made on the applications for 2,400 shares. It was decided to utilise excess application money towards the amount due on allotment.

X, to whom 40 shares were allotted, failed to pay the allotment money and on his subsequent failure to pay the first call his shares were forfeited.

Y, who applied for 72 shares failed to pay the two calls and on his such failure his shares were forfeited.

Of the shares forfeited 80 shares were sold to Z credited as fully paid-up for ₹ 9 per share the whole of Y’s shares being included. Prepare Journal, Cash Book and the Balance Sheet.

Solution:

We hope the TS Grewal Accountancy Class 12 Solutions Chapter 8 Accounting for Share Capital help you. If you have any query regarding TS Grewal Accountancy Class 12 Solutions Chapter 8 Accounting for Share Capital, drop a comment below and we will get back to you at the earliest.

TS Grewal Accountancy Class 12 Solutions Chapter 8 Accounting for Share Capital Read More »

b

b